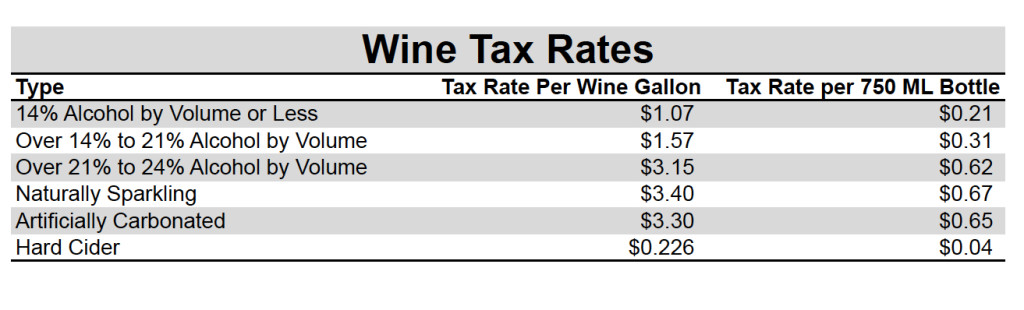

One of the major functions of the TTB, the federal agency that has primary jurisdiction over alcohol beverages in the U.S., is to collect federal excise taxes on alcohol beverages. As TTB more thoroughly explains on its website, excise tax rate depends on commodity type as well as product. See Tax and Fee Rates; see also Quick Reference Guide to Wine Excise Tax. For example, TTB’s current tax rates for alcohol are divided between beer, wine, and spirits and then subdivided into a hierarchy based on class/type (e.g., table wine, dessert wine, artificially carbonated wine, etc.).

(Note: There are exceptions, such as small domestic producer credit, to the above.)

One of the important distinctions, especially for wine tax purposes, is the division between table wine and dessert wine class/types. Often, clients will submit a label approval for a wine over 14% ABV and TTB will classify the product as “dessert wine,” even though the wine—for consumption purposes—is technically not a dessert wine. The agency’s reasoning pertains to the chart and tax rates above. Generally speaking, for tax purposes, a wine above 14% ABV will be classified as a “dessert wine” for class/type purposes and taxed at a higher rate than a wine with an ABV percentage at or below 14% ABV. The latter (i.e., the wine at or below 14% ABV) would fall into the “table wine” class/type and also be taxed at a lower tax rate per gallon or per 750 ML bottle.

A perjury statement accompanies each label approval submitted to TTB, meaning that all statements on a wine’s label—including the alcohol by volume percentage—must be truthful and correct. The agency does allow some degree of flexibility with respect to the ABV percentage stated (i.e., 27 CFR 4.36(b)(1) allows for a 1.5% tolerance for wine containing 14% of less of alcohol by volume), but not to the extent the agency presumes an industry member may be avoiding a higher tax bracket from which the government stands to obtain revenue. If a label represents the wine to be in a lower tax class (i.e., at or below 14% ABV) but the actual wine in the bottle contains a higher ABV percentage (i.e., above 14%) to render it belonging to a higher tax class, the agency can take measures against said industry member. As many industry members know, the agency also conducts random samplings of wines currently available on the market to ensure compliance with federal regulations and to maintain that products available to consumers are, indeed, accurately represented. At a recent conference I attended, a TTB representative commented that, in the last year, almost 700 alcohol beverage products were pulled in the market and close to 200 of those products did not conform with what the label stated.

Recently, TTB recognized that the owner of Monterey Wine Cellar, Brenda Jo Kibbee, was sentenced for intentional failure to pay federal excise taxes. See Owner Of Monterey Wine Cellar Sentenced To Prison For Failure To Pay Wine Excise Tax. The owner was sentenced to nine months’ imprisonment and ordered to pay $877,126.94 in restitution to TTB. As reported by the United States Attorney’s Office for the Northern District of California, the wine cellar had taxable wine removed from its bonded wine cellar premises during reporting period of August 1, 2008 through “at least” May 31, 2009. Id. “The sentence was handed down by the Honorable D. Lowell Jensen, United States District Court Judge, in San Jose.” Id.

The type of business is also key to excise tax structure. Generally, the proprietor of the bonded wine premises who removes the wine from bond for domestic consumption or sale is responsible for paying excise taxes. 27 CFR 24.270. In the case of Monterey Wine Cellar, the cellar was responsible for paying the excise taxes to TTB for taxable wine removed from the wine cellar. In most cases, these bonded wine cellars will pay the excise taxes to TTB directly but invoice their winery customers for these expenses. With respect to Monterey Wine Cellar, Ms. Kibbee invoiced and received payment from her winery clients for respective excise tax amounts but failed to pay the excise taxes due to the federal government.

In conclusion, to answer the above mentioned question, federal excise taxes are indeed important to the wine industry—especially when the government stands to lose a percentage or totality of its revenue. For more information, TTB maintains an extremely helpful section on its website explaining the duties of brewers, distillers, and wineries with respect to excise taxes and filing.

Image property of On Reserve: A Wine Law Blog.

For more information on wine or alcohol law, excise taxes, licensing, or TTB matters, please contact Lindsey Zahn.

DISCLAIMER: This blog post is for general information purposes only, is not intended to constitute legal advice, and no attorney-client relationship results. Please consult your own attorney for legal advice.

Comments (2)